Support the Seminary

This is your moment to step into the heart of the Church’s mission.

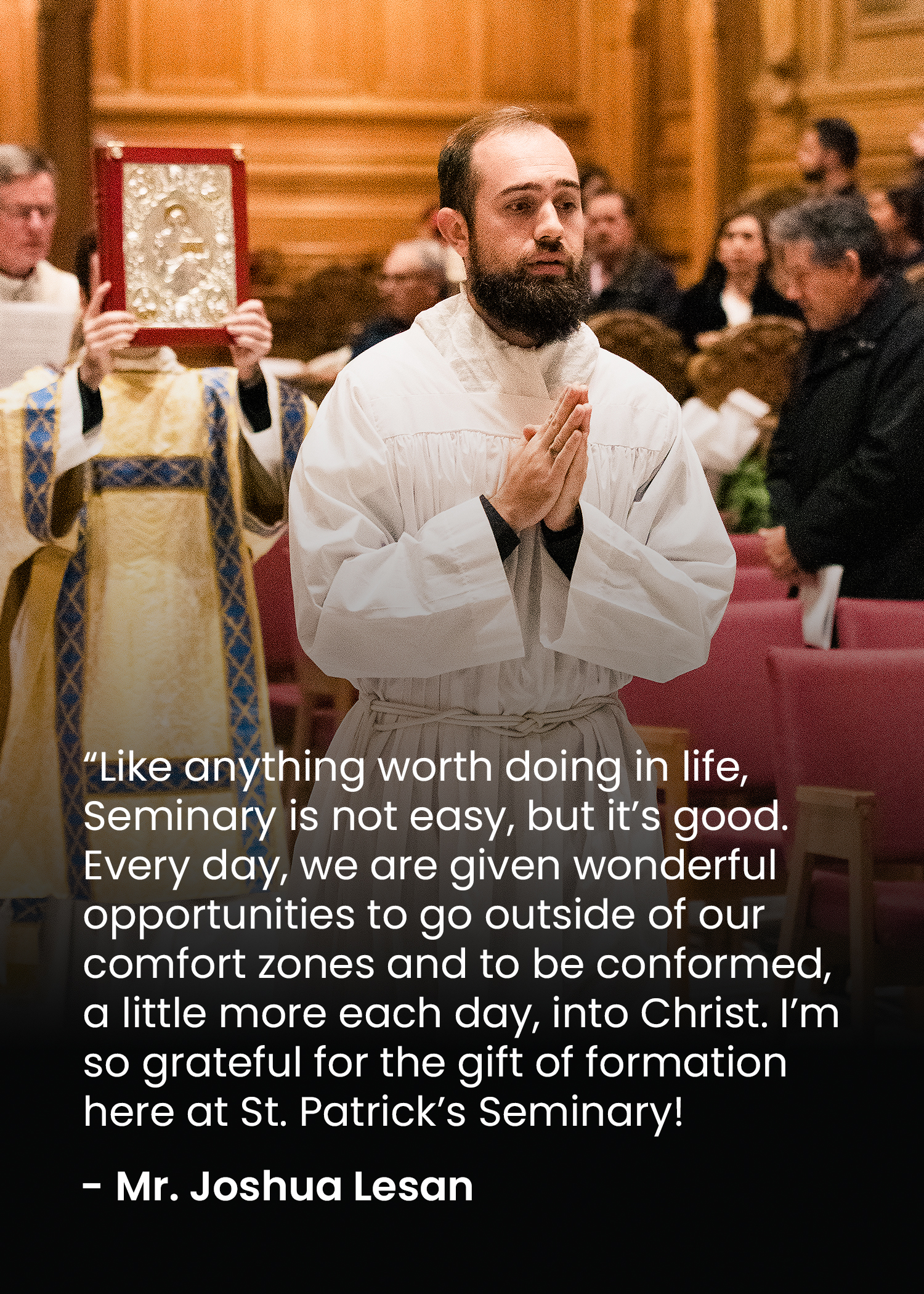

Your gift is an investment in the Church’s future. For generations, St. Patrick’s Seminary has formed hundreds of priests who now serve in parishes, schools, ministries, and missions across the country. These men are the spiritual leaders who baptize our children, celebrate the sacraments, preach the Gospel, and walk with families through every season of life.

When you give, you play a direct role in their formation. You ensure they receive the theological education, spiritual guidance, and pastoral training they need to shepherd healthy, vibrant parish communities. Your generosity helps prepare them to lead with wisdom, compassion, and courage—strengthening the Church today and for decades to come.

Simple Ways to Give

There are many ways to support our mission, and these are some of the simplest to get started with.

Give Online

Give online with ease and confidence, knowing your generosity is processed safely and put to work immediately.

→

Legacy Planning

Leave a legacy of support for future seminarians. Bequests and charitable remainder trusts are among the ways to fulfill your philanthropic goals for St. Patrick’s Seminary.

→

Want to explore a pledge or discover other ways to support

St. Patrick’s Seminary? Let’s start a conversation.

Mrs. Martha Sheridan | Director of Philanthropy and Special Events

martha.sheridan@stpsu.edu or (650) 289-3355

Other Ways to Support the Seminary

By Phone

To make a gift by phone and for more information about the ways to give listed below, please contact Martha Sheridan in the Advancement Office at (650) 289-3355.

By Mail

Checks made payable to St. Patrick’s Seminary may be mailed to:

St Patrick’s Seminary Advancement Office

320 Middlefield Rd.

Menlo Park, CA 94025

A downloadable Pledge Form is linked here.

Gifts of Stock & Annuities

To make a gift of stock, please contact Martha Sheridan in the Advancement Office at (650) 289-3355. All transfers are handled through the Archdiocese of San Francisco.

IRA Qualified Charitable Distributions

Individual retirement arrangement (IRA) owners age 70½ or over can transfer up to $100,000 to charity tax-free each year.

These transfers, known as qualified charitable distributions or QCDs, offer eligible older Americans a great way to easily give to charity. And, for those who are at least 73 years old, QCDs count toward the IRA owner’s required minimum distribution (RMD) for the year.

Planned Giving

Leave a legacy of support for future seminarians. Bequests and charitable remainder trusts are among the ways to fulfill your philanthropic goals for St. Patrick’s Seminary. Learn more about legacy planning here.

Planned Giving donors are recognized as members of the Archbishop Riordan Legacy Society. A downloadable Letter of Intent is linked here.

Matching Gifts

Maximize your personal gift with a corporate match. When you donate to St. Patrick’s, submit a matching gift request to your employer. St. Patrick’s tax EIN is 94-1156604.

In-Kind Donations

We are pleased to receive gifts of goods or services that answer a specific need. To discuss whether your gift can serve St. Patrick’s, please contact Martha Sheridan in the Advancement Office at (650) 289-3355.

We recommend you consult your tax advisor to explore the tax benefits specific to in-kind donations.